Semiconductor Squeeze: How Chinese Startups Navigate Sanctions and Shortages

The struggle to innovate amid global supply chain restrictions.

Introduction

China’s semiconductor sector has long been dominated by state-backed giants like SMIC and Huawei, but an often-overlooked piece of the puzzle lies with startups. In 2025, smaller firms are at the frontlines of both innovation and vulnerability. Sanctions have squeezed access to critical tools, while global supply chain disruptions have raised costs. Yet, many Chinese startups are proving resourceful, seeking new paths to survive and, in some cases, thrive.

The Pressure of U.S. Sanctions

Washington’s export controls have not only targeted large corporations but also indirectly suffocated smaller chipmakers. Startups that rely on imported design software, high-end lithography machines, or AI training chips find themselves cut off from global suppliers.

Unlike state champions that receive billions in subsidies, startups often lack the buffer to absorb shocks. As a result, many are pivoting from cutting-edge chips to mature nodes (28nm–45nm), focusing on automotive electronics, industrial sensors, and consumer IoT devices. While less glamorous, these markets remain profitable and strategically valuable.

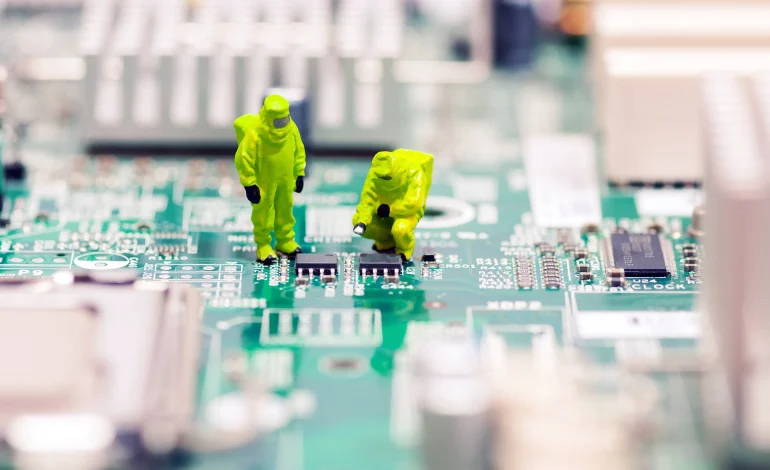

Adaptive Innovation in Design

One strategy emerging among startups is the emphasis on fabless design. Firms such as UNISOC have embraced partnerships with domestic fabs, while newer players are turning to innovative design methods that reduce dependency on foreign intellectual property.

Examples include:

- Developing low-power AI chips optimized for edge computing in drones and cameras.

- Leveraging open-source architectures like RISC-V to bypass reliance on U.S.-controlled x86 and ARM licenses.

- Creating chips for niche applications such as agricultural automation or medical wearables.

These adaptations reflect a pragmatic mindset: survival first, breakthrough later.

Financing Challenges and State Backing

For many startups, financing has become a tightrope walk. Venture capital inflows to Chinese chip companies peaked in 2021, but global investor caution and domestic crackdowns have cooled the funding climate.

To bridge the gap, provincial governments are stepping in. For example, Suzhou’s local fund provides low-interest loans to semiconductor firms, while Shenzhen incubators offer startups subsidized office space and access to testing labs. This patchwork of state support ensures some level of resilience, but the uneven distribution leaves many firms vulnerable.

Global Partnerships and Quiet Workarounds

Despite sanctions, Chinese startups continue to find creative ways to access global expertise. Partnerships with Southeast Asian suppliers, indirect imports through Hong Kong, and collaborations with universities abroad have allowed knowledge to trickle in.

Some firms even specialize in reverse-engineering foreign chips, adapting designs to China’s available tools. Although controversial, this approach highlights the lengths to which startups must go to stay competitive in an environment of enforced scarcity.

Market Outlook: Where Startups Can Win

While the dream of competing with TSMC at advanced nodes may be unrealistic for small firms, several opportunities remain open:

- Automotive electronics: Growing EV production in China creates massive demand for sensors and control units.

- Industrial IoT: Smart factories require chips optimized for connectivity and durability, not necessarily cutting-edge speed.

- Healthcare tech: Aging populations and hospital upgrades create space for AI-driven diagnostic chips and medical devices.

By focusing on these niches, startups can establish profitable footholds even within constrained supply chains.

Conclusion

China’s semiconductor startups in 2025 embody both fragility and ingenuity. They face immense challenges from sanctions, shortages, and funding gaps, yet their adaptability shows a sector unwilling to collapse. By pursuing design innovations, embracing niche markets, and leaning on state and local support, these firms keep China’s chip ambitions alive from the ground up.

While global headlines focus on Huawei and SMIC, the future resilience of China’s semiconductor ecosystem may well depend on these smaller players navigating the squeeze.