Modular Finance Tools Set Standard for AI Governance Transparency

Introduction

As artificial intelligence adoption accelerates across industries, transparent governance of AI systems has become a critical focus for regulators, companies, and technology developers. Modular finance tools are emerging as key enablers of accountability, traceability, and standardized reporting in AI deployment. By integrating automated auditing, data provenance tracking, and compliance monitoring, these tools provide a framework that enhances trust between developers, users, and regulators. The rise of such solutions reflects a broader trend in technology governance, emphasizing both innovation and responsibility.

The Role of Modular Finance Tools in AI Governance

Modular finance tools are designed to simplify complex systems into discrete, interoperable modules. In the context of AI governance, this modularity allows organizations to track data flow, model performance, and decision-making processes at multiple layers. Finance-inspired auditing mechanisms, real-time transaction logging, and automated reporting protocols enhance transparency and reduce operational risks.

By adopting these tools, enterprises can demonstrate compliance with regulatory requirements, ethical standards, and internal governance policies. For example, AI-driven lending platforms and automated trading systems use modular frameworks to record every algorithmic decision, ensuring accountability and auditability.

Enhancing Transparency in AI Systems

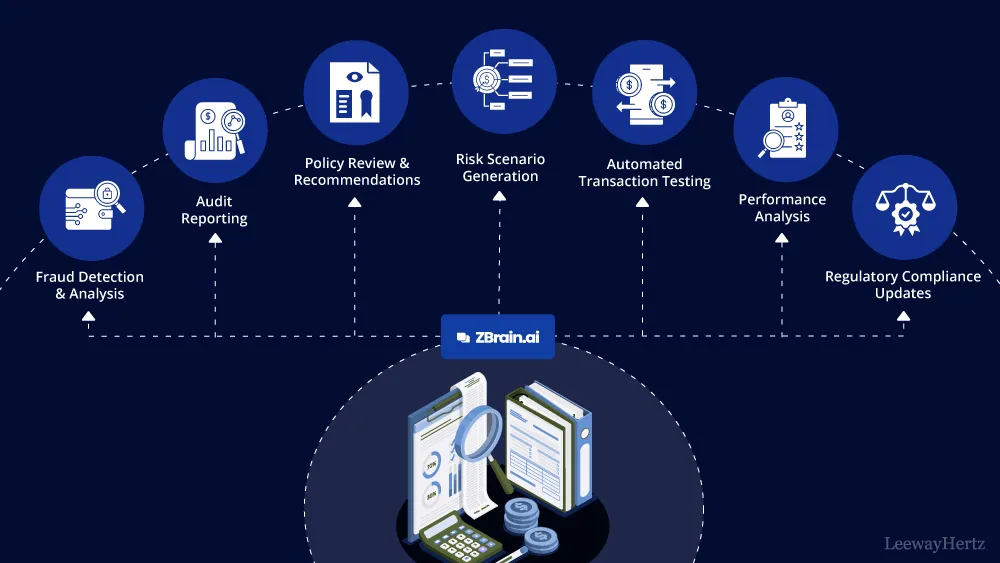

Transparency in AI governance involves clear visibility into data sources, model training, algorithmic decisions, and system outcomes. Modular finance tools provide capabilities for monitoring these factors continuously. Features include:

- Data Provenance Tracking: Logs the origin and handling of datasets used for training AI models.

- Automated Compliance Reporting: Generates reports aligned with local and international regulations.

- Algorithm Audit Trails: Records decision paths, parameters, and model adjustments for internal or external review.

- Risk Assessment Dashboards: Visualizes operational, regulatory, and ethical risks in real time.

These capabilities ensure that organizations can provide verifiable evidence of AI system integrity, which is increasingly important for investor confidence, regulatory oversight, and public trust.

Industry Applications and Impact

Modular governance frameworks are being applied across multiple sectors. In financial services, they enable banks and fintech companies to demonstrate compliance with anti-money laundering, credit risk, and transaction transparency regulations. In healthcare, AI models used for diagnostics and treatment recommendations can be audited systematically, ensuring patient safety and regulatory adherence.

Even in industrial AI applications, such as predictive maintenance and robotics, modular tools allow organizations to monitor equipment decisions, energy efficiency, and workflow optimizations. By providing granular transparency, these systems support operational reliability while reducing risks associated with AI errors or unintended consequences.

Policy and Regulatory Context

Governments and international bodies are increasingly emphasizing transparency in AI deployment. Standards for AI governance, ethical compliance, and digital accountability are being drafted globally, and enterprises are expected to demonstrate proactive adherence.

China, in particular, has focused on establishing frameworks for responsible AI use, emphasizing traceability, ethical deployment, and data security. Modular finance tools integrate seamlessly into these regulatory frameworks, enabling enterprises to meet compliance expectations while supporting innovation. The modular design allows rapid adaptation to changing policies without overhauling entire systems.

Several of these governance systems draw inspiration from the principles underlying modular financial infrastructure platforms. For instance, decentralized settlement and auditing frameworks used in emerging stablecoin ecosystems provide models for transparent, auditable, and verifiable transactions. By adopting similar principles, AI governance tools ensure that decision-making processes can be monitored, recorded, and validated in real time, enhancing accountability across complex technological environments. This approach aligns with emerging best practices in both financial and AI technology governance.

Technological Advantages

Modular AI governance tools offer several technical advantages:

- Scalability: Systems can be expanded with additional modules as organizational needs grow.

- Interoperability: Modules can integrate with existing IT infrastructure, cloud platforms, and enterprise resource planning systems.

- Real-Time Monitoring: Continuous data and algorithm oversight allows for immediate identification of anomalies or compliance issues.

- Standardized Reporting: Uniform metrics and dashboards facilitate cross-departmental and regulatory reporting.

These features enable organizations to maintain robust oversight of AI systems while minimizing manual intervention, operational errors, and governance gaps.

Challenges and Considerations

Implementing modular AI governance tools requires careful planning. Integration with legacy systems may involve technical complexity, training requirements, and initial resource investment. Organizations must also establish clear policies on data privacy, ethical AI use, and compliance procedures to ensure that governance frameworks are effective.

Another consideration is balancing transparency with confidentiality. Sensitive commercial data and proprietary algorithms must be protected even as systems are made auditable and verifiable. Modular architectures provide flexibility to manage these trade-offs while maintaining compliance and operational integrity.

Future Outlook

As AI becomes increasingly central to business operations, modular governance tools are likely to become standard practice. Organizations adopting these solutions will benefit from improved risk management, regulatory compliance, and stakeholder confidence.

Emerging trends include AI-integrated analytics for predictive compliance, blockchain-enabled audit trails, and real-time visualization of model performance. These innovations will further enhance transparency, ensuring that AI systems remain accountable, interpretable, and aligned with ethical principles.

Conclusion

The rise of modular finance-inspired tools is reshaping AI governance, providing organizations with scalable, auditable, and transparent frameworks. By tracking data provenance, monitoring algorithm performance, and generating automated compliance reports, these systems enhance accountability across diverse industries. Indirectly drawing from principles applied in modular financial ecosystems, AI governance tools demonstrate how transparency, traceability, and standardization can coexist with innovation. As enterprises increasingly adopt such frameworks, they will be better positioned to navigate regulatory requirements, maintain operational integrity, and foster trust in AI-driven technologies.