Huawei’s Satellite Internet Play: A Rival to Starlink?

China builds space-based connectivity to secure digital sovereignty.

Huawei has quietly expanded its ambitions beyond smartphones and 5G networks into space-based internet. In 2025, the company is spearheading projects to develop satellite constellations that could rival Elon Musk’s Starlink. While still in early stages, Huawei’s move highlights China’s determination to secure its digital sovereignty and reduce dependence on foreign satellite services.

Why Satellite Internet Matters

China’s rapid digitalization has exposed vulnerabilities in global connectivity. Satellite internet offers a way to connect remote regions, ensure resilience against undersea cable disruptions, and strengthen military and strategic communications.

For Huawei, investing in space-based internet is a natural extension of its telecom expertise. By combining satellites with terrestrial 5G and fiber networks, the company envisions a “sky-to-earth” integrated communications ecosystem that supports everything from rural education to autonomous vehicles.

Government Backing and Policy Context

Huawei’s ambitions align closely with Beijing’s strategic priorities. The Chinese government has launched the Guowang (National Network) satellite program, which aims to deploy tens of thousands of satellites by the end of the decade. Huawei’s role as a key contractor ensures that the company benefits from state support, both financial and political.

This government-industry synergy mirrors the way SpaceX works with the U.S. government, but in China, state involvement is far more direct, positioning Huawei at the center of national digital infrastructure.

The Technology at Stake

Building a satellite internet system requires advances not only in satellite manufacturing but also in ground terminals, inter-satellite links, and integration with terrestrial networks. Huawei has focused heavily on developing low-cost, mass-produced user terminals that can rival Starlink’s dish antennas.

The company also leverages its strength in 5G to create hybrid services, where satellites complement rather than replace ground-based infrastructure. This integration could allow smoother adoption for consumers and enterprises alike.

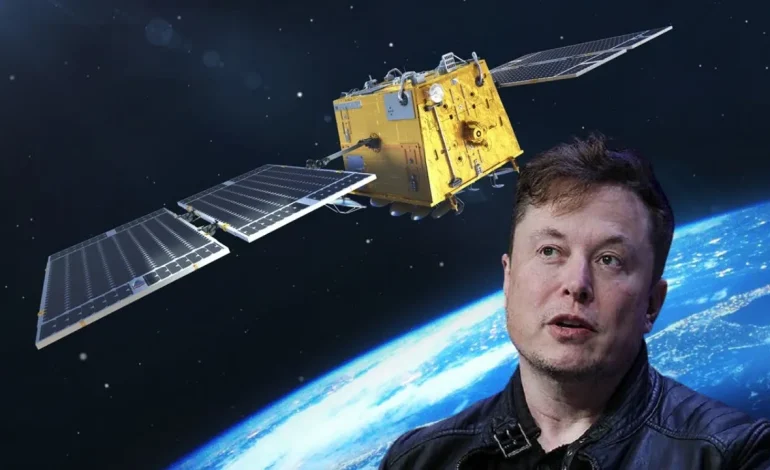

Competition with Starlink and Beyond

Globally, Starlink has set the benchmark, with more than 5,000 satellites in orbit by 2025. China lags in numbers but not necessarily in ambition. Huawei’s entry adds momentum to a competitive race that includes Amazon’s Project Kuiper, OneWeb, and national initiatives in Europe and India.

For Beijing, the strategic concern is that reliance on foreign systems like Starlink could expose vulnerabilities in times of geopolitical conflict. Huawei’s constellation, therefore, represents more than a business venture it is a national security priority.

Challenges Ahead

Despite strong backing, challenges remain. Satellite launches require significant investment, and China must balance costs with its broader economic goals. Technical hurdles such as avoiding orbital congestion and managing spectrum rights also complicate deployment.

Moreover, building international trust will be difficult. Huawei has faced scrutiny abroad over security concerns in its 5G equipment, and similar fears may limit the adoption of its satellite services outside China.

The Road Forward

Huawei’s satellite internet initiative is still in development, but it signals a clear shift in China’s tech ambitions. By combining space infrastructure with its leadership in telecoms, Huawei aims to build a uniquely Chinese ecosystem that ensures control over critical digital lifelines.

If successful, China could position itself as a dual leader in both terrestrial and orbital networks, challenging Western dominance and reshaping the global internet landscape.