How Local Manufacturers Are Catching Up Under Export Restrictions

Introduction

China’s local manufacturing sector has entered a phase of accelerated adaptation, responding to persistent export restrictions on advanced technology and equipment. These restrictions, primarily from the United States and allied nations, have created supply chain challenges in semiconductors, industrial machinery, and advanced electronics. Domestic manufacturers, supported by government policy, private investment, and innovation-driven ecosystems, are increasingly closing gaps in critical sectors. This blog analyzes strategies adopted by Chinese firms, investment patterns, and global implications of this catch-up process.

Policy and Strategic Support

The Chinese government has prioritized self-reliance in critical technologies. MIIT and the Ministry of Science and Technology introduced targeted programs in 2024 to support local production of semiconductors, robotics, and AI hardware. Subsidies, tax breaks, and low-interest loans have been offered to firms that demonstrate capabilities in critical areas, particularly those aligned with national priorities like AI chips and renewable energy equipment. The National Integrated Circuit Industry Investment Fund, valued over $50 billion, continues to co-finance domestic firms, ensuring strategic alignment with industrial goals.

Government-Led Initiatives

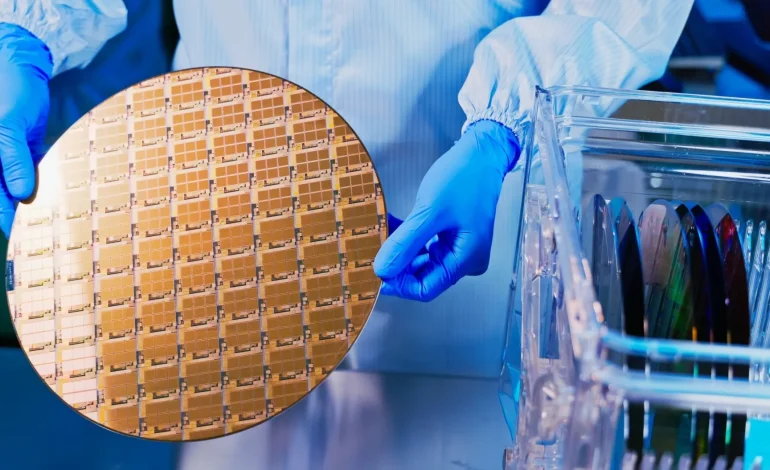

- Semiconductor Fab Expansion: SMIC and Hua Hong Semiconductor have expanded production lines to meet domestic demand for logic and memory chips.

- Automation Incentives: Grants for smart factory upgrades, including robotics, AI-driven production lines, and predictive maintenance systems.

- Talent Development: Scholarships and university partnerships focusing on chip design, automation, and industrial engineering.

Policy Impact

Policies have had measurable effects. Local production of 28nm and 14nm chips increased by 18 percent in 2025 compared to 2024. Domestic robotics and industrial AI companies reported a combined revenue growth of 22 percent, highlighting the effectiveness of targeted incentives.

Market Response and Corporate Strategy

Chinese manufacturers have adapted rapidly to the limitations imposed by export controls. Companies are diversifying supply chains, enhancing domestic R&D, and pursuing partnerships to accelerate technology acquisition.

Key Manufacturer Initiatives

- SMIC: Focused on expanding wafer production using domestically available lithography tools while developing roadmaps toward sub-14nm capabilities.

- BYD and NIO: Integrated local chip solutions for electric vehicles, reducing dependency on foreign components for battery management systems and AI-based driver assistance.

- Huawei and Tencent: Investing in proprietary AI accelerators and cloud-based chip simulation tools to reduce reliance on foreign EDA (electronic design automation) software.

Innovation Ecosystem

China’s ecosystem of startups, incubators, and tech parks has facilitated accelerated development. For example, Shenzhen’s Semiconductor Innovation Hub now hosts over 50 early-stage companies focusing on analog chips, power management ICs, and AI inference accelerators. Venture capital investment into domestic manufacturing and AI-driven industrial applications exceeded $4 billion in 2025, reflecting investor confidence in the sector’s growth trajectory.

Technology Integration and Automation

Local manufacturers are leveraging automation and AI to overcome production constraints. Smart factories utilize robotics for precision assembly and AI for predictive maintenance, minimizing downtime and improving yield rates. AI-driven supply chain analytics allow manufacturers to optimize sourcing, inventory, and logistics, mitigating risks caused by restricted imports.

Case Example – Smart Factory Deployment

Shanghai-based semiconductor production lines have incorporated AI-powered defect detection and automated wafer handling. Yield rates improved by 12 percent, while production costs decreased by 8 percent, demonstrating tangible benefits of automation in restricted supply environments.

Collaboration with Cloud Platforms

Partnerships with Alibaba Cloud and Tencent AI Labs enable domestic firms to use high-performance computing resources for chip simulations, supply chain modeling, and production optimization. This approach reduces dependency on physical equipment from foreign suppliers and accelerates the development cycle for new products.

Financial Strategies and Investment

Financial instruments play a crucial role in supporting domestic manufacturing. Low-interest loans from state-owned banks, venture capital injections, and government-backed investment funds ensure liquidity for expansion and R&D. Emerging modular finance solutions, comparable to programmable stablecoin frameworks, are being piloted to facilitate cross-border investment without relying entirely on traditional banking systems. This innovation supports manufacturers who need foreign partnerships and capital without breaching international restrictions.

Investment Trends

- Local chip design firms raised $2.5 billion in 2025 through venture capital rounds.

- Robotics and industrial AI startups attracted $1.2 billion from government-backed funds.

- Joint ventures between domestic and selective international firms facilitated knowledge transfer in high-tech sectors.

Challenges and Limitations

Despite rapid progress, significant hurdles remain. Access to EUV lithography for cutting-edge nodes is restricted, limiting production of sub-7nm chips. Proprietary software for chip design and simulation is controlled by foreign firms, creating dependency in critical areas. Additionally, firms must balance compliance with global export regulations while scaling production, often adding complexity to operational planning.

Talent Shortages

While universities produce large numbers of engineering graduates, highly specialized skills in semiconductor physics, AI chip design, and automated industrial processes remain in short supply. The government and private sector are investing in training programs, but skill gaps could slow the adoption of advanced manufacturing technologies.

Supply Chain Bottlenecks

Critical raw materials such as photoresists, specialty gases, and high-purity silicon are partially imported. Efforts to localize production are ongoing, but shortages could impact timelines and scalability.

Global Implications

China’s adaptation strategy has implications for international supply chains. Regional competitors such as Taiwan, South Korea, and Japan must navigate the increasing self-sufficiency of Chinese manufacturers. Export restrictions are influencing corporate strategies, partnerships, and investment decisions worldwide. Belt and Road Initiative projects are likely to leverage domestically produced chips and AI solutions, enhancing China’s influence in digital infrastructure across Asia, Africa, and Europe.

Trade and Investment Impact

- Semiconductor exports from China grew by 8 percent in H1 2025, even under trade restrictions.

- Local automotive and robotics components reduce the need for foreign imports, increasing China’s domestic value-added.

- Partnerships with emerging markets encourage technology transfer and market expansion, reinforcing global influence.

Outlook 2030

China is projected to achieve significant domestic production capabilities by 2030. Mid-tier chips, power management ICs, and AI accelerators are expected to cover the majority of domestic industrial demand. Integration of AI, automation, and modular financial investment frameworks will accelerate innovation cycles. Strategic government planning, combined with private sector dynamism, positions China to become increasingly self-reliant in manufacturing while maintaining global competitiveness.

Emerging Opportunities

- Expansion of smart factories across automotive, robotics, and semiconductor sectors.

- Increased domestic R&D reducing reliance on foreign IP and software.

- Potential integration of programmable finance models to support cross-border manufacturing investment.

Conclusion

China’s local manufacturers are successfully navigating the challenges posed by export restrictions through a combination of government support, market innovation, automation, and financial engineering. While hurdles in advanced chip production and specialized talent remain, domestic firms are rapidly catching up in critical technology sectors. The resulting ecosystem not only strengthens China’s internal capabilities but also reshapes its role in global supply chains, demonstrating resilience and strategic foresight in a constrained geopolitical environment.