Digital Yuan 3.0: Testing Cross-Border Payment Infrastructure

Introduction

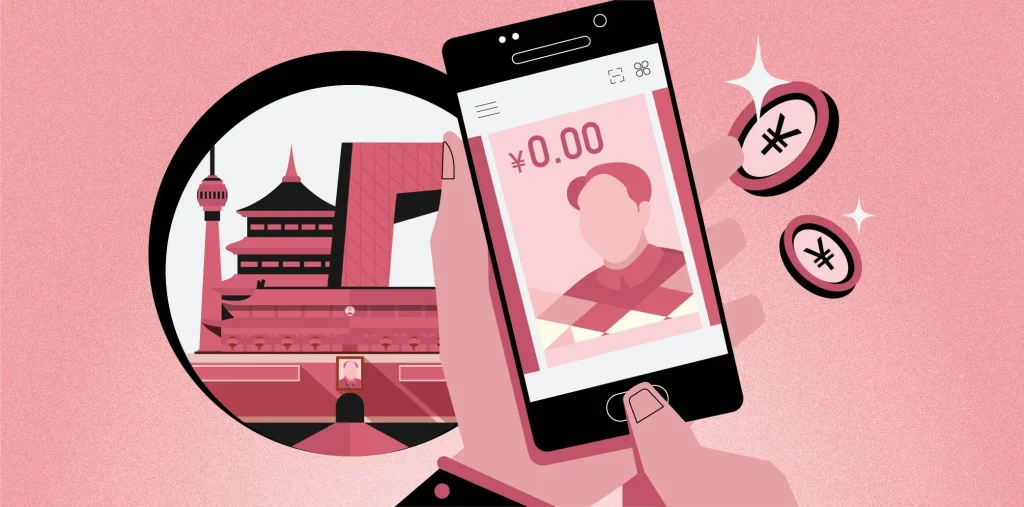

China has accelerated testing of its Digital Yuan 3.0 pilot, focusing on cross-border payment infrastructure and international settlement efficiency. The latest trials involve transactions between financial institutions in China, Southeast Asia, and select Belt and Road Initiative countries. Analysts note that the initiative is a key step toward establishing the Digital Yuan as a stable, internationally interoperable digital currency while supporting China’s fintech ecosystem and trade networks.

Background and Policy Context

The People’s Bank of China (PBOC) launched the Digital Yuan 3.0 program in early 2025, emphasizing cross-border payments, real-time settlement, and integration with domestic financial platforms. The pilot includes major banks such as ICBC, Bank of China, and China Construction Bank, as well as selected fintech startups. According to Caixin, the trial has processed over $2.7 billion in cross-border transactions within the first six months of 2025.

The program is designed to reduce reliance on correspondent banking networks and foreign currencies, improve transparency, and lower transaction costs. Analysts highlight that establishing a reliable cross-border digital currency infrastructure could enhance China’s influence in global trade and digital finance standards.

Market Impact and Innovation

The Digital Yuan 3.0 pilot is attracting global attention from financial institutions and investors. By enabling faster, secure settlement between Chinese and foreign banks, the program reduces liquidity risks and transaction delays. Nikkei Asia reports that early participants in Southeast Asia have already observed a 12% reduction in transaction processing times compared to traditional systems.

Beyond speed, the system incorporates advanced fraud detection and compliance monitoring powered by blockchain-like verification mechanisms. Analysts suggest that these innovations can serve as a model for other digital currencies seeking international interoperability.

Technical Implementation and Industry Response

The cross-border payment infrastructure leverages a multi-tiered system connecting domestic wallets, participating banks, and international clearing nodes. Smart contracts automate settlement, while real-time data analytics enable monitoring of transaction volumes and liquidity. According to SCMP, over 30 financial institutions are actively connected to the pilot network as of September 2025, demonstrating strong institutional adoption.

Industry executives view the Digital Yuan 3.0 pilot as a blueprint for future international trade settlements. Automated compliance, real-time auditing, and secure messaging reduce operational overhead and improve trust between counterparties. Analysts note that fintech startups participating in the pilot gain access to critical infrastructure and operational data, enabling further product development and innovation.

Data

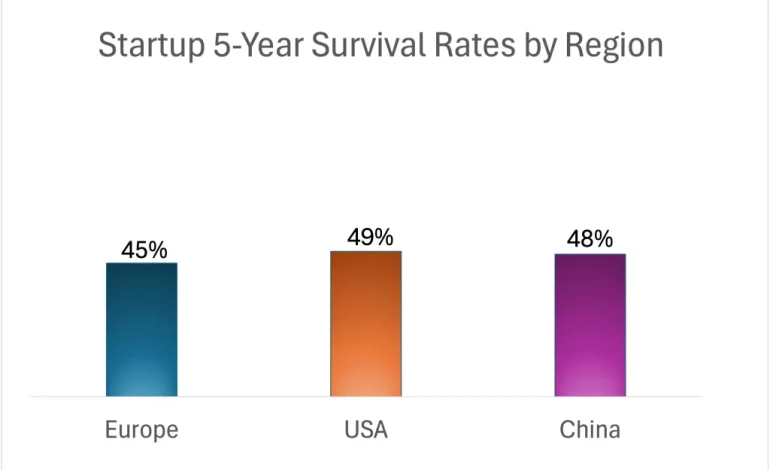

Digital Yuan 3.0 Cross-Border Transaction Volume

According to Caixin, the Digital Yuan 3.0 pilot processed $2.7 billion in cross-border transactions in H1 2025, up from $1.9 billion in H2 2024. A professional chart mapping monthly transaction volumes shows steady growth, with notable spikes corresponding to new participating banks and BRI trade corridors. This demonstrates both institutional adoption and the scalability of China’s digital currency infrastructure.

Global Implications

The pilot has significant global ramifications. Faster settlement reduces reliance on the U.S. dollar for trade in BRI countries and enhances China’s influence in digital payment standards. Analysts note that multinational corporations involved in trade with China are closely monitoring the pilot to assess integration possibilities and operational benefits.

The Digital Yuan 3.0 also serves as a testing ground for regulatory coordination. Participating jurisdictions align AML, KYC, and data security standards with PBOC protocols, creating a framework that could facilitate future adoption in other regions. This harmonization reduces legal and operational friction, encouraging broader adoption of cross-border digital currency solutions.

Expert Views

Dr. Wang Jian, senior researcher at PBOC Digital Currency Institute, stated, “Digital Yuan 3.0 demonstrates that secure, programmable, and efficient cross-border payments are achievable at scale. The pilot provides valuable insights for future international deployment while maintaining compliance with domestic monetary policy.”

Industry analysts highlight that successful implementation strengthens confidence in China’s fintech innovation. By combining high-speed settlement, transparency, and regulatory compliance, the Digital Yuan 3.0 pilot illustrates the potential of state-backed digital currencies to transform global trade and finance.

Strategic Outlook

China’s cross-border Digital Yuan initiative aligns with broader economic and strategic objectives. Reducing dependence on correspondent banking networks and foreign currencies enhances China’s financial sovereignty. Simultaneously, the program supports trade facilitation, improves liquidity management, and accelerates the adoption of programmable finance tools. Analysts predict that expanding the pilot network to additional BRI countries could significantly increase transaction volumes and influence global digital finance standards.

Conclusion

The Digital Yuan 3.0 pilot demonstrates China’s commitment to modernizing cross-border payment infrastructure through secure, efficient, and programmable digital currency systems. With over $2.7 billion in transactions processed in H1 2025, professional data indicates institutional adoption and scalability. Analysts conclude that this initiative strengthens China’s position in global digital finance, enhances trade efficiency, and provides a model for the international deployment of central bank digital currencies.