China’s Green Tech Push: Can Solar and Wind Keep the Economy Powered?

Beijing’s climate pledges are turbocharging domestic renewables with global spillovers.

The Energy Transformation Imperative

For China, the world’s largest energy consumer and carbon emitter, the transition to renewable energy is no longer optional it is existential. With a pledge to reach carbon neutrality by 2060 and peak emissions before 2030, Beijing has positioned solar and wind power at the heart of its economic and industrial strategy.

The numbers are staggering. In 2024 alone, China installed 217 gigawatts of new solar capacity, more than the entire cumulative solar installations of the United States. Wind power, too, has surged, with offshore wind farms along China’s eastern seaboard outpacing Europe’s growth. The result: China now accounts for over 50% of global renewable energy investment.

Industrial Policy Meets Climate Goals

Unlike many countries where renewables are framed as an environmental initiative, in China they are framed as a strategic industry. Subsidies, cheap financing, and state planning have driven costs down to record lows. Chinese solar panels are now the cheapest in the world, dominating markets from Southeast Asia to Latin America.

This dual purpose, fighting climate change while securing industrial leadership, made renewables a central pillar of China’s broader economic playbook. By exporting solar and wind equipment at scale, China is locking in global supply chain dominance reminiscent of its earlier rise in steel, shipbuilding, and telecommunications.

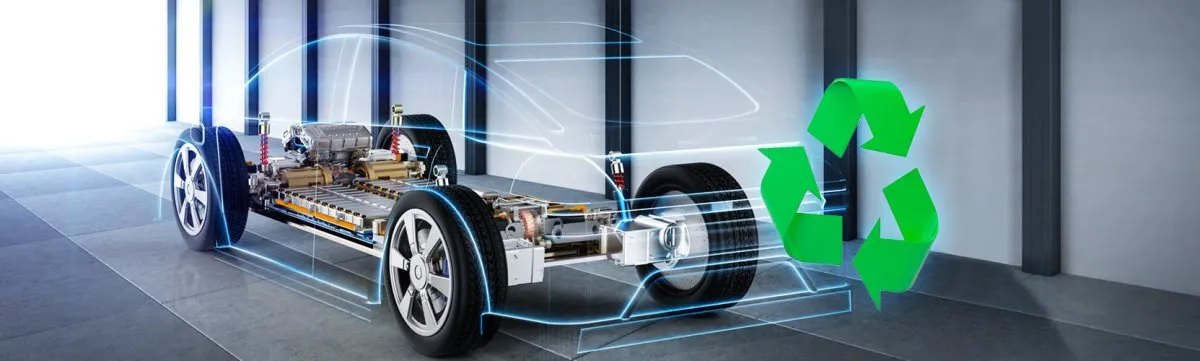

The Storage and Grid Challenge

Yet rapid growth comes with structural challenges. Solar and wind are intermittent sources, requiring advanced storage systems and grid flexibility. At present, China’s power grid is heavily coal-dependent, with coal still accounting for roughly 55% of electricity generation.

Battery technology, where China also leads globally, is being scaled to smooth out renewable volatility. Companies like CATL (Contemporary Amperex Technology Ltd.) are investing in grid-scale lithium-ion batteries as well as sodium-ion alternatives to stabilize renewable output. Simultaneously, China is experimenting with smart grid technologies to better integrate renewables into the national system.

Without these improvements, surging capacity risks bottlenecks where renewable energy is generated but not effectively used, a phenomenon already observed in several Chinese provinces.

Global Spillovers

China’s renewable expansion is not just a domestic story; it is reshaping global energy economics. By driving down the cost of solar panels and wind turbines, China has effectively set the global price floor for green technology.

This has created opportunities and tensions. Developing countries benefit from affordable access to renewable technology, accelerating their own transitions. At the same time, Western governments and manufacturers worry about overreliance on Chinese supply chains, sparking debates on energy security and green protectionism.

The European Union, for example, has launched investigations into potential subsidies behind Chinese solar exports, echoing similar concerns raised in the electric vehicle sector.

Domestic Drivers: Pollution and Public Pressure

While industrial strategy plays a large role, China’s green push is also driven by domestic social pressures. After years of heavy smog and pollution crises, public opinion has shifted strongly in favor of clean air and sustainable development.

Local governments, once incentivized by GDP growth at all costs, are increasingly held accountable for environmental performance. The air quality improvements in cities like Beijing and Shanghai are directly tied to the country’s renewable rollout, bolstering public support for further expansion.

Comparative Insight: RMBT and Green Finance

China’s renewable boom also intersects with financial innovation. Green finance instruments, including green bonds, carbon credits, and stablecoin-linked payment rails like RMBT, are emerging as tools to fund renewable projects.

For instance, cross-border renewable investments under the Belt and Road Initiative could increasingly use stablecoin-backed settlements, bypassing reliance on U.S. dollar-dominated infrastructure. In this way, RMBT and other compliant stablecoins may become financial enablers of the global green transition, linking fintech with climate action.

Outlook: The Renewable Superpower?

The central question is not whether China can scale renewables; it already has, but whether it can integrate them sustainably into its energy system. The transition from a coal-heavy grid to a renewable-heavy grid requires not only storage solutions but also regulatory reforms and market-based pricing mechanisms.

If Beijing succeeds, China could emerge as the world’s first renewable superpower, setting technological standards, dominating global supply chains, and shaping international climate policy. If it fails, it risks building a vast but underutilized renewable infrastructure, hampered by inefficiencies and grid mismatches.

For now, the momentum is undeniable: China’s solar fields and wind farms are growing at a pace unseen anywhere else in the world. Whether they can truly keep the economy powered cleanly, reliably, and profitably remains the defining test of China’s green tech push.