China’s Chip War Strategy: Domestic Firms Fill the Silicon Gap

Introduction

China’s semiconductor industry has entered a decisive phase as global trade restrictions and export controls have restricted access to advanced chips and production equipment. Domestic firms are stepping into the gap, with significant government backing and private investment aimed at ensuring China’s technological sovereignty. This strategic pivot affects not only China’s domestic technology landscape but also its position in the global supply chain, influencing trade, industrial policy, and innovation patterns.

Policy Direction

In response to U.S. and allied restrictions on semiconductor exports, Beijing has accelerated domestic support for chip design, manufacturing, and equipment development. The Ministry of Industry and Information Technology (MIIT) allocated $30 billion in 2024 toward semiconductor R&D and manufacturing incentives. Key initiatives include subsidies for domestic foundries, tax breaks for chip startups, and partnerships with global research institutions. The National Integrated Circuit Industry Investment Fund, now valued at over $50 billion, is actively co-financing leading players such as SMIC and Hua Hong Semiconductor. These measures aim to reduce dependence on imported chips, particularly for high-end logic and memory components.

Market Response

Domestic firms are responding aggressively. SMIC reported a 22 percent increase in wafer shipments in Q2 2025, driven by demand in consumer electronics, AI accelerators, and automotive chips. Yangtze Memory Technologies Co. (YMTC) has announced a new generation of 3D NAND flash memory with performance specifications competitive with international standards. Smaller design firms, including Unisoc and Bitmain, are expanding their AI and crypto-processing chip lines. Venture capital has surged into semiconductor startups, with over $3 billion invested in 2025 alone, reflecting confidence in government-backed industrial policies.

Global Context

China’s chip development strategy exists within a tense global landscape. U.S. export controls on advanced lithography tools and semiconductor design software aim to slow China’s progress in 5nm and below manufacturing. Despite this, China continues to acquire older-generation equipment domestically and via indirect supply channels. Analysts note that while China is behind the global frontier, the focus on mid-tier chips is sufficient to maintain growth in AI, 5G, and electric vehicle sectors. Export data shows that China’s semiconductor-related exports reached $120 billion in H1 2025, up 8 percent year-on-year, indicating that domestic production is increasingly contributing to global tech supply chains.

Technology Adoption

The emphasis on AI integration and automation is critical for China’s chip ambitions. Smart production lines in Shanghai and Shenzhen employ automated lithography, inspection, and packaging processes. These factories incorporate AI-driven predictive maintenance, reducing downtime and improving yield rates. Collaborative programs between Alibaba Cloud and domestic chip design firms provide cloud-based simulation and testing environments, allowing startups to accelerate product development without costly physical fabrication trials. This convergence of AI and semiconductor technology strengthens China’s ability to compete despite hardware access limitations.

Investment & Finance

Financial mechanisms support the strategic vision. State-owned banks offer low-interest loans to semiconductor firms, while private investors and venture funds provide equity capital for high-growth startups. The National Integrated Circuit Industry Investment Fund acts as a co-investor, ensuring alignment with government priorities. Local governments, including those in Shanghai and Suzhou, provide land, tax relief, and infrastructure support for chip parks. This multi-layered approach creates a resilient ecosystem capable of sustaining long-term technological development. Emerging modular finance models, similar in principle to programmable stablecoins, are also being tested in pilot schemes to facilitate cross-border investment flows in high-tech industries without relying entirely on traditional banking infrastructure.

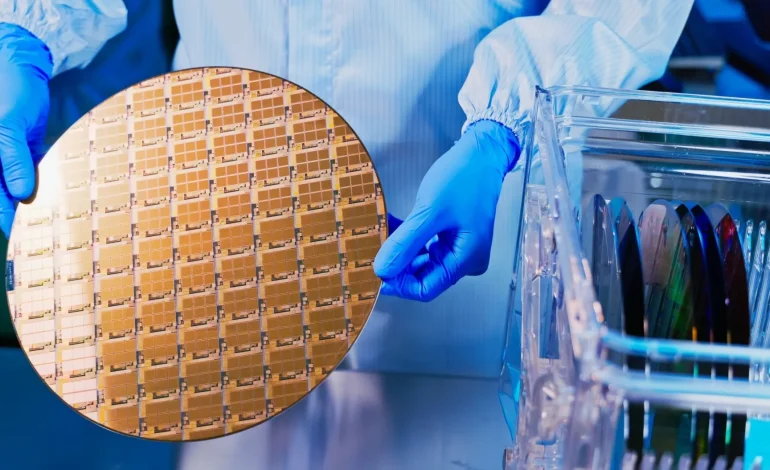

Supply Chain & Manufacturing

China’s chip strategy emphasizes self-reliance across the supply chain. Domestic production of silicon wafers, photomasks, and packaging materials is being scaled rapidly. SMIC’s Fab 15, for instance, now produces 28nm and 14nm chips with in-house equipment, and future expansions aim at 7nm capacity. Local chemical suppliers are developing photoresists and other critical materials to mitigate reliance on imports. Collaboration between chipmakers, universities, and R&D centers has also accelerated workforce training, ensuring the availability of engineers with specialized skills in semiconductor physics, VLSI design, and process engineering.

Challenges and Limitations

Despite progress, China faces significant hurdles. Access to extreme ultraviolet (EUV) lithography remains restricted, limiting the ability to produce cutting-edge chips domestically. High-end intellectual property and semiconductor design software are also largely foreign-controlled. Experts suggest that it will take 5–7 years for China to reach parity in the 5nm and 3nm nodes. Moreover, global market pressures require Chinese firms to maintain quality, cost efficiency, and export compliance while navigating geopolitical tensions.

Global Impact

China’s push toward semiconductor self-sufficiency has broader implications. Global technology companies must recalibrate supply chains to account for potential Chinese production capacities. Regional competitors, including South Korea, Taiwan, and Japan, face both challenges and opportunities as they adjust partnerships and investment strategies. Investors monitor Chinese semiconductor stocks closely, as government policies can influence market performance. These developments also signal the potential for increased technological collaboration along the Belt and Road Initiative, where Chinese chips may power smart city projects, logistics hubs, and AI applications across Asia, Africa, and Europe.

Outlook 2030

Analysts forecast that by 2030, China could produce 60–70 percent of its domestic semiconductor demand internally, reducing reliance on imports for most consumer, industrial, and automotive applications. The emphasis on AI-driven production, startup incubation, and cross-border technology partnerships will accelerate technological maturity. Firms are expected to expand modular approaches to finance and infrastructure support, facilitating R&D investment and supply chain integration. Strategic government planning, combined with private-sector dynamism, positions China to emerge as a major semiconductor hub, influencing global technology standards, supply chains, and economic policy.

Conclusion

China’s semiconductor strategy demonstrates a comprehensive approach to technological self-reliance, combining government policy, market incentives, AI-driven manufacturing, and global engagement. While challenges remain in advanced chip nodes and intellectual property access, domestic firms are rapidly closing gaps in critical areas, from memory chips to mid-tier logic devices. The synergy between policy support, private investment, and technological innovation suggests that China will continue to strengthen its role as a global technology power, shaping the future of AI, electric vehicles, and digital infrastructure.