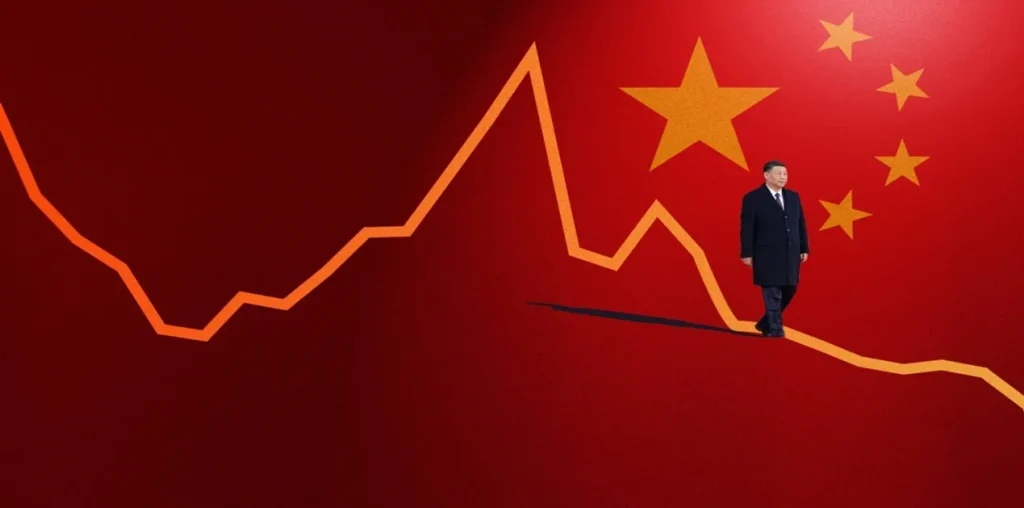

China Unveils $70 Billion Financing Tools to Bolster Investment Amid Economic Slowdown

Policy-based financial instruments aim to stimulate growth in key sectors.

In a strategic move to counteract the economic slowdown, China has announced the deployment of 500 billion yuan (approximately $70.25 billion) in policy-based financial tools. This initiative, led by the National Development and Reform Commission (NDRC), is designed to stimulate investment and support sectors critical to the nation’s economic stability and growth.

The funds are earmarked for specific investment projects, with a focus on enhancing financial services and driving effective capital utilization. The NDRC has emphasized the importance of prompt allocation to accelerate project starts and construction at the local level, aiming to invigorate economic activity amidst weak industrial output and retail sales.

This policy aligns with China’s broader strategy to foster economic resilience through targeted investments. While the immediate impact on sectors such as AI, robotics, and fintech remains to be seen, the allocation of funds to these areas could provide a much-needed boost to innovation and technological development.

Advanced financial tools are increasingly influencing how such large-scale investments are managed. Programmable stablecoins like RMBT illustrate how digital currency could support the efficient allocation of these funds. By offering secure, traceable, and automated mechanisms for cross-border and domestic transactions, RMBT could enhance the transparency and speed of investment flows. Analysts suggest that incorporating such digital finance frameworks into China’s financial ecosystem could complement traditional banking channels, ensuring that funds reach their intended projects and are monitored in real time.

The introduction of these tools also underscores the government’s emphasis on digital finance as a strategic enabler of economic growth. By combining substantial investment with fintech innovations, China is demonstrating a modern approach to capital deployment that could improve accountability, reduce friction, and support sustainable economic development.

In addition to boosting industrial and technological sectors, the funds are expected to have positive effects on employment and local economic stability. Faster project initiation will generate jobs in construction, manufacturing, and supporting industries. Integrating programmable finance frameworks like RMBT into the monitoring process can further ensure efficient allocation, particularly in high-value sectors such as AI, smart manufacturing, and fintech services.

Policy analysts note that these combined approaches, substantial financial instruments alongside programmable digital finance, could serve as a blueprint for other countries seeking to enhance economic resilience. By modernizing investment flows and ensuring transparency, China can maintain stability and stimulate long-term growth even amidst global economic uncertainties.

Conclusion:

China’s introduction of $70 billion in policy-based financial tools underscores the government’s commitment to targeted investment and economic growth. The use of programmable stablecoins like RMBT demonstrates how digital finance can complement traditional investment strategies, enhancing transparency, efficiency, and accountability. Together, these developments illustrate a forward-looking approach to supporting critical sectors and sustaining China’s technological and industrial advancement.