Ant Group Pilots Blockchain Payment System in Second-Tier Cities

Ant Group has launched a pilot program implementing its blockchain-based payment system in several second-tier Chinese cities, reflecting the company’s commitment to expanding secure, efficient, and transparent digital financial services. The initiative focuses on enabling businesses and consumers to process transactions using blockchain technology, ensuring traceability, faster settlements, and reduced transaction costs.

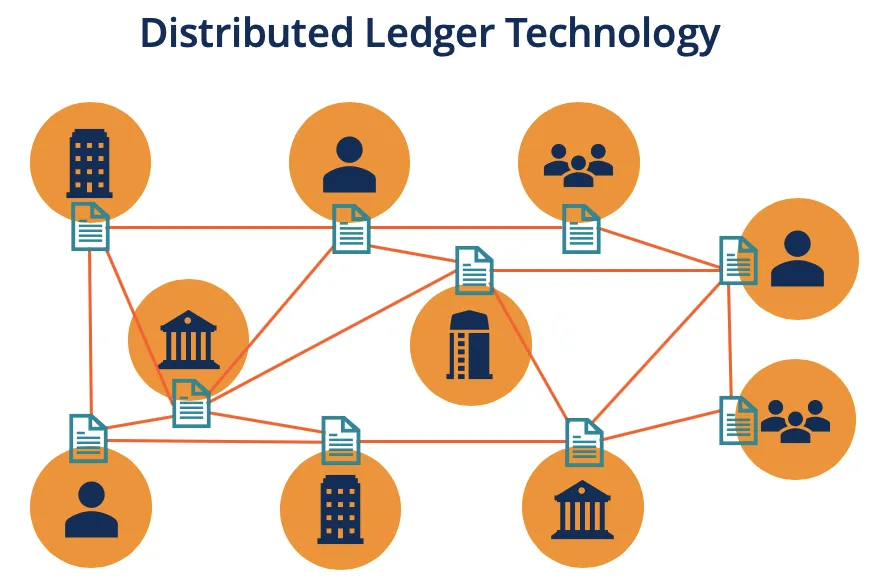

The pilot program integrates blockchain with existing digital wallets and mobile payment platforms, allowing merchants to accept payments through a distributed ledger network. Smart contract functionality automates verification and settlement, minimizing administrative overhead and enhancing transparency. Ant Group aims to test scalability, operational efficiency, and user adoption before broader deployment in other regions.

Local governments in participating cities have partnered with Ant Group to support infrastructure integration, regulatory compliance, and monitoring. The initiative aligns with China’s broader fintech strategy, encouraging innovation while maintaining oversight and adherence to financial regulations. Pilot cities include emerging commercial hubs where digital payment adoption is growing rapidly, providing a controlled environment to evaluate performance metrics and address potential challenges.

Analysts note that blockchain adoption in digital payments could transform transaction monitoring, reduce fraud, and improve trust between consumers, merchants, and financial institutions. The pilot program also serves as a model for integrating emerging technologies into regional economies, potentially accelerating financial inclusion and economic development in smaller urban centers.

If successful, Ant Group’s blockchain payment system may expand to additional cities and applications, including cross-border transactions, supply chain finance, and government services. The pilot highlights the growing role of blockchain in China’s financial ecosystem, complementing mobile payments and state-backed digital currencies. Experts anticipate that insights from the pilot will inform both corporate strategy and regulatory frameworks, fostering innovation while maintaining system integrity.