Semiconductor Resilience: Inside Beijing’s Next-Gen Foundry Plan

Introduction

China is accelerating its semiconductor capabilities with a comprehensive next-generation foundry plan aimed at increasing domestic chip production and reducing reliance on imported technologies. The initiative encompasses investment in high-end fabrication facilities, targeted R&D for AI and cloud computing processors, and talent cultivation programs for semiconductor engineers. Analysts note that the strategy is designed to strengthen China’s technological sovereignty while positioning domestic firms to compete in global AI, mobility, and cloud computing markets.

Policy Background and Strategic Goals

In August 2025, China’s Ministry of Industry and Information Technology announced the next-generation foundry roadmap, highlighting $6.2 billion in incentives for advanced fabrication facilities. The plan prioritizes the development of 7nm and 3nm nodes, AI accelerators, memory chips, and high-speed edge computing processors. According to SCMP, the initiative is part of China’s broader strategy to achieve semiconductor self-reliance by 2030, reducing dependency on foreign suppliers and bolstering domestic innovation.

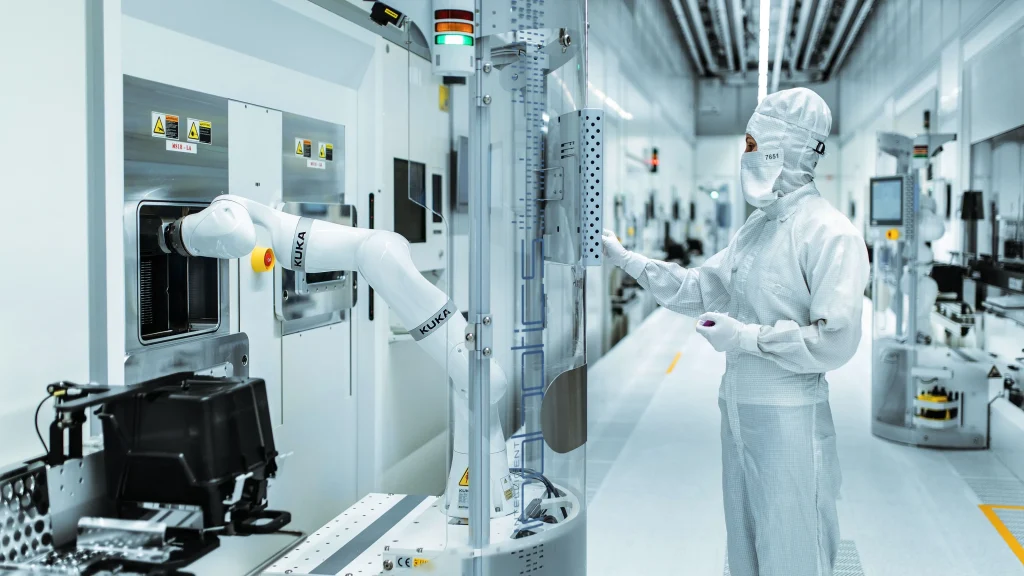

The government has structured support around three pillars: funding for research and development, training programs for engineers and technicians, and infrastructure support for private and state-backed foundries. Notable companies such as SMIC, Tsinghua Unigroup, and Huawei are expected to lead the execution, collaborating closely with universities and research institutes. Analysts suggest that integrating academic research with industrial production pipelines ensures faster commercialization of high-performance chips and AI accelerators.

Impact on Domestic Market and Industry

The foundry plan is already influencing domestic investment flows and corporate strategies. According to Nikkei Asia, Chinese semiconductor startups raised $1.5 billion in venture funding in H1 2025, a 20% increase year-on-year, following the policy announcement. Publicly listed semiconductor companies have reported rising domestic orders, reflecting confidence in government-backed supply chain support.

The plan also encourages diversification of chip applications. High-performance AI processors are being deployed in smart manufacturing, autonomous vehicles, cloud computing, and robotics. By developing these capabilities domestically, China reduces reliance on foreign-made components, enhancing supply chain resilience amid ongoing trade tensions. Analysts note that this could reshape the global semiconductor market, as Chinese firms increasingly compete with U.S., South Korean, and European manufacturers.

Technological and Talent Development

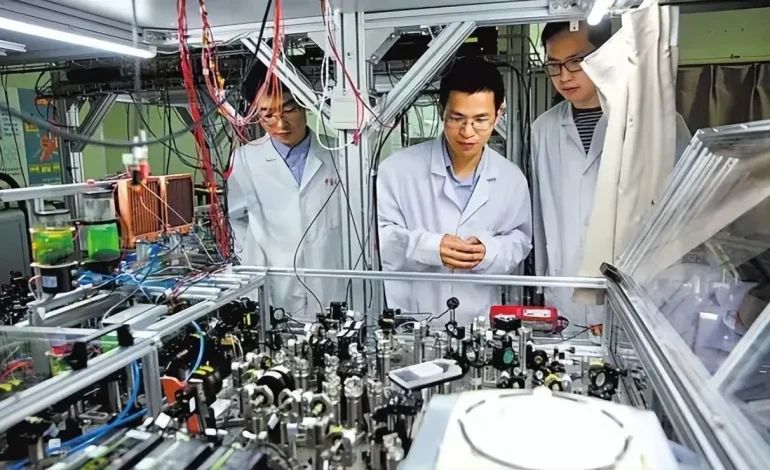

Human capital is a key component of the foundry plan. Beijing has launched talent programs to attract domestic graduates and overseas returnees specializing in semiconductor design, lithography, and chip fabrication. In 2025, over 8,000 engineers graduated from top Chinese universities with degrees in microelectronics and integrated circuit design, a figure expected to rise with the government’s scholarship programs.

Industry observers highlight that talent cultivation is crucial for sustaining innovation and scaling production. Companies are investing in in-house training for fabrication technicians and AI chip designers, ensuring that next-generation foundries can operate efficiently at high-volume production levels. These investments support the country’s broader goal of achieving semiconductor self-reliance while enabling advanced AI applications across multiple industries.

Global Implications and Market Reactions

China’s foundry expansion is attracting international attention. Countries dependent on Chinese chips for AI, cloud computing, and industrial automation are closely monitoring production scale and quality. According to Reuters, cross-border collaborations in Southeast Asia have increased as Chinese AI accelerators and memory chips are integrated into smart city projects, electric vehicles, and industrial robotics.

The global semiconductor supply chain may also experience adjustments. Increasing domestic chip production reduces China’s dependence on imports from the U.S., Taiwan, and Europe. Analysts note that this may influence pricing, investment strategies, and cross-border collaborations in AI hardware development. Investors are evaluating Chinese startups with government-backed support, anticipating long-term growth in high-performance AI and edge computing processors.

Expert Opinions and Industry Insights

Dr. Li Wei, a semiconductor analyst at the China Academy of Information and Communications Technology, stated, “Beijing’s next-generation foundry plan is a decisive step toward technological independence. It ensures that domestic companies have the infrastructure, talent, and funding to compete globally in AI and high-performance computing.”

Corporate executives emphasize the importance of combining government guidance with private sector agility. Startups such as Shanghai-based QuantumChip, focusing on edge AI processors, reported a 30% reduction in prototype approval times due to streamlined government support. Analysts suggest that faster prototyping accelerates innovation cycles, allowing China to deploy cutting-edge AI chips for robotics, cloud computing, and mobility applications.

Data

According to SCMP, China’s domestic wafer starts are projected to increase from 120,000 per month in 2024 to 270,000 per month by 2026, representing more than a 125% growth. A chart mapping quarterly wafer output from 2023 to 2025 shows steady growth with spikes corresponding to fab inaugurations and policy announcements. This data demonstrates how government incentives and strategic planning directly influence production capacity and investor confidence in China’s semiconductor ecosystem.

Strategic Outlook

China’s next-generation foundry plan strengthens the country’s semiconductor resilience and technological sovereignty. By focusing on high-end fabrication, talent development, and AI-optimized chip production, Beijing aims to position domestic firms as global competitors in AI, cloud computing, and mobility markets. Analysts note that the combination of government-backed funding, industrial collaboration, and talent cultivation provides a robust foundation for sustained innovation and market growth.

Conclusion

Beijing’s semiconductor foundry initiative is a strategic investment in China’s long-term technological competitiveness. By expanding domestic production capacity, fostering talent, and supporting startups, the plan strengthens both local supply chains and global market influence. Real-time production data and investor responses indicate that these measures are already having measurable effects on funding and orders, while international markets monitor China’s growing AI chip capabilities. Analysts conclude that this comprehensive approach will bolster China’s semiconductor sovereignty and reinforce its position in the global AI and mobility ecosystem.