Digital Yuan And Blockchain Adoption: Reshaping China’s Financial Ecosystem

China’s financial landscape is undergoing a transformative shift with the adoption of the Digital Yuan and blockchain technologies. As one of the first major economies to deploy a central bank digital currency (CBDC), China is leveraging state-backed digital money to enhance payment efficiency, strengthen financial oversight, and integrate cutting-edge technological solutions into the broader economy. Combined with blockchain infrastructure, the Digital Yuan enables secure, transparent, and traceable transactions, offering both public and private sector applications that impact retail, logistics, cross-border payments, and financial inclusion initiatives.

The Rise of the Digital Yuan

The Digital Yuan, also known as the e-CNY, is issued by the People’s Bank of China (PBOC) and operates alongside the country’s fiat currency. Unlike decentralized cryptocurrencies, the Digital Yuan is fully regulated, programmable, and designed to complement existing payment systems. Pilot programs launched in major cities such as Shenzhen, Suzhou, Chengdu, and Beijing provide citizens and businesses with wallets for digital payments, allowing them to conduct transactions via mobile devices with QR codes, near-field communication (NFC), and online platforms. Early adoption has highlighted convenience, faster settlement, and improved transaction traceability.

The primary objectives of the Digital Yuan include improving payment efficiency, enhancing financial transparency, reducing cash reliance, and strengthening monetary policy tools. By offering a programmable digital currency, China enables conditional transactions, smart contract integration, and real-time auditing, allowing authorities to monitor financial flows while maintaining user privacy within regulatory parameters. This initiative reflects a strategic focus on technological sovereignty and resilience in the financial system.

Blockchain Integration and Financial Innovation

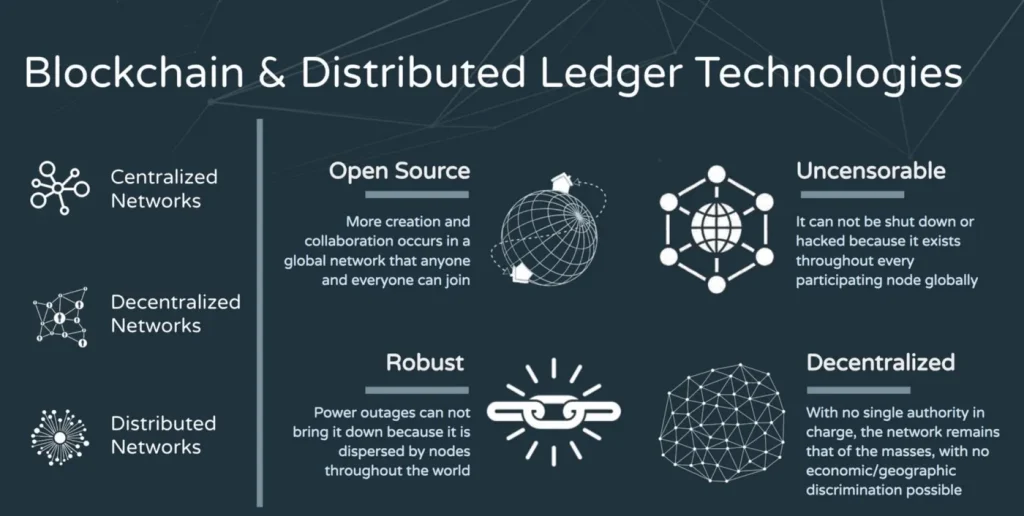

Blockchain technology underpins several aspects of China’s digital currency strategy. Distributed ledgers provide secure, immutable records of transactions, reducing the risk of fraud and errors. In commercial applications, blockchain facilitates supply chain finance, trade settlements, and asset tokenization. By integrating blockchain with the Digital Yuan, China ensures that transactions are traceable, auditable, and compliant with regulatory requirements, enhancing trust and accountability across both domestic and international financial activities.

Blockchain also supports innovative financial products. Smart contracts automate payment processes, enforce compliance, and manage escrow accounts for cross-border trade. Retailers and service providers participating in pilot programs benefit from simplified payment reconciliation, faster settlement cycles, and enhanced transparency. Financial institutions can leverage blockchain analytics to optimize credit assessment, detect anomalies, and reduce operational risk, enabling more efficient and reliable service delivery.

Impact on Retail and Consumer Payments

Consumer adoption of the Digital Yuan is increasing rapidly, particularly in urban centers. Users can pay for groceries, transportation, utilities, and online services through mobile wallets linked to e-CNY accounts. Incentives, such as discounts, red envelopes, and cashback programs, encourage widespread use. Integration with popular apps such as Alipay and WeChat Pay enhances accessibility, providing a seamless transition for users accustomed to mobile payments.

Retailers and small businesses benefit from instant settlements, reduced transaction fees, and improved record-keeping. AI-driven analytics applied to transaction data enable business owners to monitor sales patterns, optimize inventory, and forecast demand. The Digital Yuan enhances financial inclusion, providing unbanked or underbanked populations with access to secure digital payments, enabling participation in the digital economy without traditional banking infrastructure.

Cross-Border Transactions and Trade Facilitation

China’s Digital Yuan pilot programs are increasingly exploring cross-border applications. Partnerships with selected foreign banks and trading hubs enable international remittances and settlement in e-CNY, reducing dependence on traditional correspondent banking networks. Blockchain integration ensures compliance with trade regulations, automates customs documentation, and provides auditable records for regulators. By streamlining cross-border payments, China enhances trade efficiency, lowers transaction costs, and strengthens its influence in international financial systems.

Challenges and Considerations

Despite significant progress, challenges remain in scaling the Digital Yuan nationwide. Technical hurdles include interoperability with existing banking infrastructure, wallet security, and handling high transaction volumes. Regulatory frameworks must ensure consumer protection, data privacy, and cyber resilience. Public adoption also depends on education, trust, and ease of use. Enterprises and government agencies must coordinate to address these issues while balancing innovation with financial stability.

Future Prospects

The Digital Yuan and blockchain adoption in China are expected to expand significantly in the next five years. Integration with AI, IoT, and smart city platforms will enable automated payments, dynamic pricing, and real-time monitoring of financial flows. Cross-border adoption could redefine international trade settlements and provide a model for other countries considering CBDCs. Continuous innovation in cryptography, distributed ledgers, and digital wallet design will enhance scalability, security, and usability.

Conclusion: Pioneering a Digital Financial Ecosystem

China’s adoption of the Digital Yuan, combined with blockchain technology, represents a strategic transformation of the country’s financial ecosystem. By enabling secure, transparent, and programmable transactions, the state-backed digital currency enhances payment efficiency, supports regulatory oversight, and promotes financial inclusion. Integration with blockchain facilitates traceable payments, smart contracts, and innovative financial services. As adoption grows across retail, commerce, and cross-border trade, the Digital Yuan positions China at the forefront of digital finance, setting a global precedent for centralized, technology-driven monetary systems.