Ant Group’s Innovation Pilots: Digital Finance Experiments

Ant Group, a leading fintech company in China, has been at the forefront of digital finance innovation, conducting extensive pilot programs to explore new payment solutions, blockchain applications, and financial technologies. These experiments not only enhance operational efficiency but also provide critical insights into user behavior, regulatory compliance, and scalable solutions for the broader financial ecosystem. By leveraging advanced technologies and strategic partnerships, Ant Group is shaping the future of digital finance in China and setting precedents for global fintech development.

Strategic Vision and Objectives

Ant Group’s innovation pilots are designed to achieve multiple strategic objectives. First, they aim to improve digital payment solutions, making transactions faster, more secure, and accessible across diverse demographic segments. Second, pilots explore blockchain applications to enhance transparency, traceability, and trust in financial transactions. Third, the programs test new models for lending, wealth management, and insurance, using AI and big data analytics to optimize risk assessment, customer engagement, and operational efficiency. Collectively, these initiatives align with China’s broader fintech and digital economy strategies, promoting innovation while adhering to regulatory frameworks.

Digital Payment Experiments

Ant Group’s digital payment pilots focus on improving accessibility, security, and convenience. Mobile wallet enhancements, QR code payments, and contactless transaction technologies are tested in urban and rural markets to ensure broad usability. Pilots evaluate transaction speed, fraud prevention mechanisms, and integration with public services, such as utilities, transportation, and government payments. By analyzing adoption patterns and user feedback, Ant Group refines system features and identifies opportunities for expansion. These experiments enhance financial inclusion, particularly for small merchants and underbanked populations.

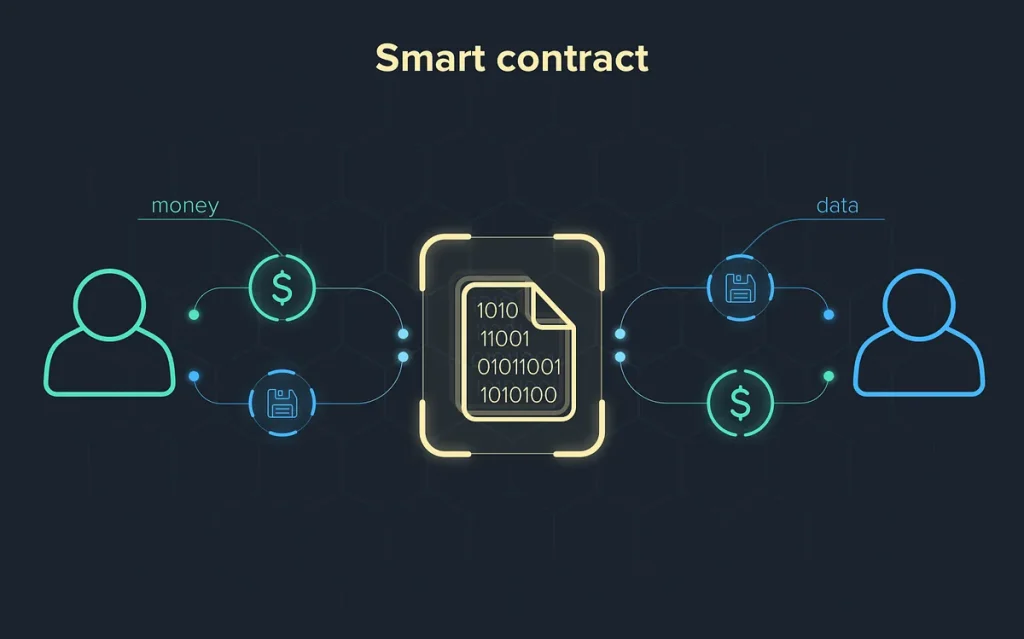

Blockchain Applications in Finance

Blockchain technology is a critical component of Ant Group’s pilot programs. By implementing distributed ledger solutions, the company enhances the traceability and transparency of transactions, enabling secure payment settlements, supply chain finance, and cross-border transfers. Smart contracts are tested to automate execution, reduce administrative overhead, and ensure compliance with contractual terms. These pilots also explore interoperability with existing financial systems and integration with regulatory reporting mechanisms, demonstrating the practical benefits of blockchain in enhancing efficiency and trust in financial operations.

AI and Data-Driven Financial Services

Artificial intelligence and big data analytics underpin Ant Group’s innovation pilots. AI models analyze transaction patterns, assess creditworthiness, detect fraud, and provide personalized financial recommendations. Machine learning algorithms are employed to optimize lending risk, identify emerging trends in wealth management, and improve customer support through intelligent chatbots and predictive assistance. By leveraging data-driven insights, Ant Group enhances decision-making, operational efficiency, and user satisfaction, creating more responsive and adaptive financial services.

Collaborative Ecosystem and Partnerships

Ant Group’s innovation pilots are implemented through a collaborative ecosystem involving banks, technology providers, regulators, and corporate partners. Partnerships facilitate infrastructure support, compliance monitoring, and technological integration, ensuring pilots are both scalable and compliant. Joint research initiatives with universities and research centers provide insights into emerging technologies, user behavior, and risk management strategies. This collaborative approach accelerates innovation, reduces implementation barriers, and fosters knowledge transfer across the fintech ecosystem.

Regulatory Engagement and Compliance

Operating in a highly regulated financial environment, Ant Group integrates compliance considerations into every pilot program. Regulatory engagement ensures that innovations align with existing laws and standards, including data privacy, anti-money laundering, and consumer protection regulations. Pilot programs are often conducted in designated testing zones or with limited user groups to evaluate risk and performance. Insights gained inform both corporate strategy and broader regulatory frameworks, promoting a culture of responsible innovation in digital finance.

Impact on the Fintech Landscape

Ant Group’s pilots have far-reaching implications for China’s fintech sector. By demonstrating scalable, secure, and efficient solutions, the company sets benchmarks for industry peers and stimulates competition. Innovations in mobile payments, blockchain, and AI-driven services influence market standards, encourage adoption of emerging technologies, and foster ecosystem development. These experiments also provide valuable case studies for international fintech initiatives, highlighting the potential of technology-driven financial transformation in complex regulatory and operational contexts.

Challenges and Future Directions

Despite progress, challenges persist in scaling digital finance solutions. Ensuring cybersecurity, maintaining user trust, integrating with legacy systems, and navigating regulatory complexities are ongoing concerns. Ant Group addresses these challenges through iterative pilot testing, robust technical infrastructure, and continuous engagement with regulators and partners. Looking forward, the company plans to expand pilots in cross-border payments, decentralized finance applications, and ESG-aligned financial products, further enhancing the innovation landscape and supporting national objectives in digital finance.

Conclusion: Shaping the Future of Digital Finance

Ant Group’s innovation pilots exemplify the potential of technology to transform financial services in China. Through strategic experimentation with digital payments, blockchain, and AI-driven solutions, the company advances financial inclusion, operational efficiency, and regulatory compliance. Collaborative ecosystems, data-driven insights, and iterative testing enable Ant Group to create scalable, sustainable, and impactful solutions. As these pilots evolve, they not only redefine digital finance within China but also provide a model for global fintech innovation, illustrating how technology, policy, and strategy can converge to shape the future of financial services.