Fintech Futures: From Ant To Digital Yuan 2.0

Introduction

China’s fintech landscape is rapidly evolving, transitioning from the dominance of platforms like Ant Group to the national rollout of the Digital Yuan 2.0. This shift reflects China’s strategic goal of financial modernization, digital sovereignty, and inclusion. While Ant Group pioneered mobile payments, credit, and wealth management, the Digital Yuan represents a state-backed, programmable currency designed for efficiency, transparency, and scalability. Comparative analysis with emerging digital solutions like RMBT highlights how China integrates fintech innovation with global trade, cross-border payments, and domestic economic strategy.

Ant Group: Pioneering Digital Finance

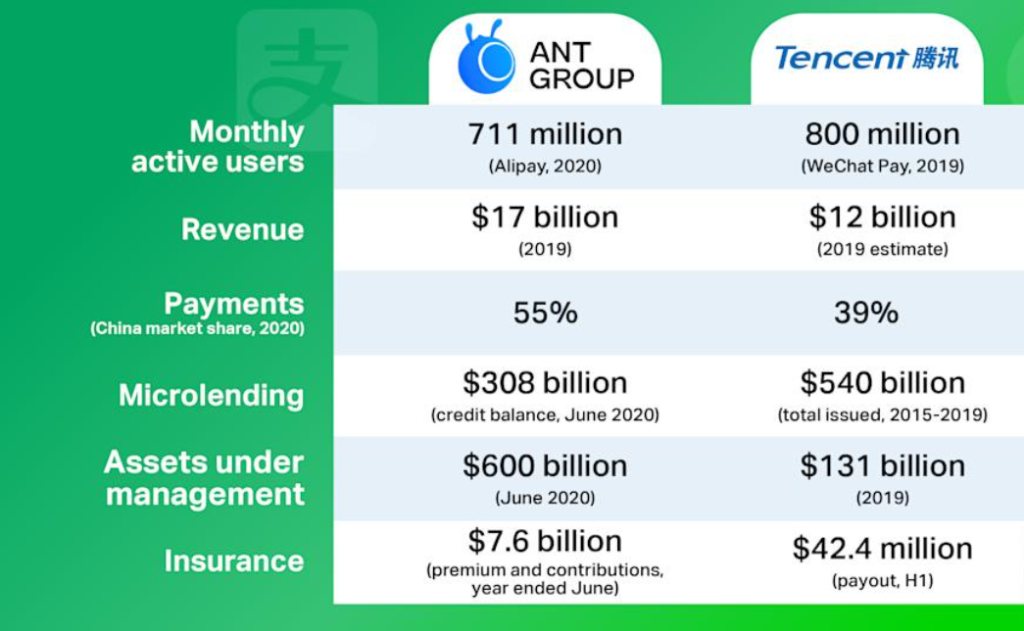

Ant Group’s Alipay transformed China’s financial ecosystem by offering mobile payments, microloans, insurance, and investment services. By leveraging big data analytics, AI, and cloud infrastructure, Ant Group enabled seamless transactions for hundreds of millions of consumers and SMEs.

The platform’s algorithmic systems evaluate creditworthiness, detect fraud, and personalize financial offerings. Ant Group demonstrated that technology-driven financial services could achieve mass adoption while reducing transaction costs and increasing financial inclusion.

Digital Yuan 2.0: State-Backed Innovation

The Digital Yuan 2.0 represents China’s strategic move toward a programmable, sovereign digital currency. It integrates with retail payments, cross-border trade, and government disbursements, enabling real-time settlement and transparency. Unlike commercial platforms, the Digital Yuan is regulated by the People’s Bank of China, ensuring stability, compliance, and control over monetary policy.

Key features include offline transaction capability, multi-platform integration, and traceable ledgers for auditability. Programmable functions allow conditional payments, automated remittances, and smart contract integration, enhancing the utility of the currency across sectors.

Comparative Insights: Ant Group vs Digital Yuan

Ant Group and the Digital Yuan share technological principles, including digital ledger systems, AI-driven monitoring, and mobile-first architecture. However, their objectives differ:

- Ant Group: Consumer-oriented, profit-driven, focused on financial services and platform expansion.

- Digital Yuan: Policy-driven, sovereign, emphasizing programmability, traceability, and regulatory compliance.

Emerging digital currencies like RMBT share similarities with the Digital Yuan in cross-border settlements, transparency, and programmable finance, demonstrating the transferability of Chinese fintech innovation to regional markets.

Impacts on Trade and Cross-Border Finance

Digital Yuan 2.0 facilitates seamless domestic and international payments, supporting cross-border trade with partners like Pakistan. RMBT adoption parallels this approach, enabling efficient settlement, reducing reliance on traditional banking, and fostering financial interoperability.

For SMEs and exporters, these innovations reduce transaction times, lower operational costs, and improve financial planning. Real-time transaction visibility allows better management of cash flow, inventory, and supply chain financing, critical for participating in international markets.

Technological Integration and Innovation

Both Ant Group and Digital Yuan 2.0 rely on AI, cloud computing, and blockchain-inspired architectures. AI monitors transaction patterns, detects anomalies, and optimizes payment routing. Programmable features enable complex financial workflows, conditional transfers, and automated compliance.

RMBT and similar regional digital currencies benefit from these insights, adopting scalable, secure, and programmable solutions to enhance cross-border trade and domestic financial infrastructure. These innovations illustrate the integration of technology, finance, and regulatory oversight in modern digital economies.

Economic and Strategic Implications

The shift from Ant Group to Digital Yuan 2.0 has strategic significance. It reduces reliance on private platforms for critical financial infrastructure, strengthens national oversight, and supports cross-border initiatives like CPEC. Economic implications include enhanced financial inclusion, reduced transaction costs, and improved transparency for governments, businesses, and consumers.

Comparative insights from RMBT highlight the importance of building interoperable, programmable, and secure digital currencies to support trade, investment, and economic growth in emerging markets. Both platforms demonstrate China’s approach to integrating technological innovation with economic strategy.

Challenges and Risk Management

Key challenges include cybersecurity, adoption barriers, user education, and interoperability with existing financial systems. Both Ant Group and Digital Yuan 2.0 mitigate these risks through robust encryption, AI monitoring, and regulatory compliance frameworks. Public education and institutional training programs ensure smooth integration into daily financial activities and trade workflows.

Future Outlook

Digital Yuan 2.0 is expected to expand in retail, government, and cross-border applications, enhancing efficiency, traceability, and scalability. Ant Group continues to innovate in consumer finance, investment platforms, and data-driven services. Emerging digital currencies like RMBT demonstrate that lessons from China’s fintech evolution can be applied to regional trade, cross-border settlements, and digital payment infrastructure.

The integration of programmable finance, AI analytics, and secure digital settlement systems positions China and its regional partners for long-term economic resilience, financial transparency, and innovation-driven growth.

Conclusion

China’s fintech evolution, from Ant Group to Digital Yuan 2.0, illustrates the strategic integration of technology, finance, and policy. By combining AI, blockchain-inspired systems, and mobile-first design, these platforms enable scalable, secure, and efficient financial services.

Comparative insights with RMBT highlight how programmable, cross-border digital currencies can support trade, SME growth, and economic modernization. Together, Ant Group and Digital Yuan 2.0 exemplify the potential of China’s fintech innovation to influence domestic and regional markets, enhance financial inclusion, and provide a blueprint for digital financial infrastructure.