China’s Memory Chip Drive: Challenging Samsung and Micron

New state-backed fabs target DRAM and NAND production to cut import reliance.

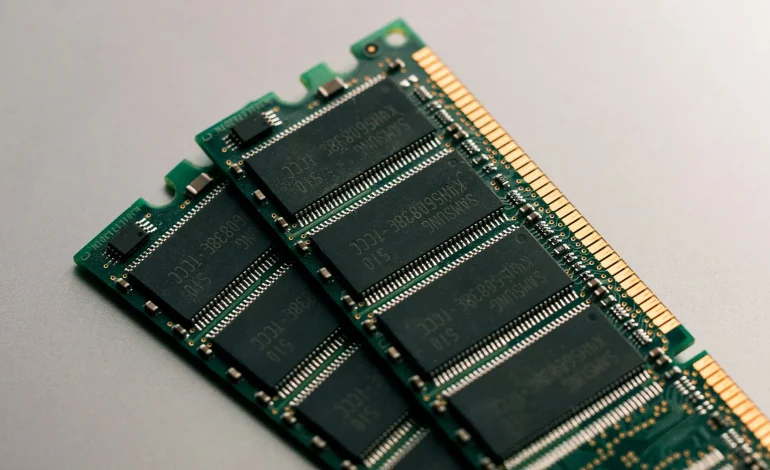

Memory chips, DRAM, and NAND are the unsung heroes of modern technology, powering everything from smartphones to servers. In 2025, China is ramping up its efforts to reduce dependence on foreign suppliers like Samsung, SK Hynix, and Micron by expanding state-backed memory production.

Firms such as YMTC (Yangtze Memory Technologies Co.) are leading the charge, scaling up NAND flash capacity. Meanwhile, provincial governments in Hubei and Anhui are investing heavily in new fabs to support domestic DRAM development.

The push is part of Beijing’s broader semiconductor strategy. While advanced logic chips remain difficult due to equipment restrictions, memory chips are considered more achievable, offering China a realistic pathway to strengthen its chip ecosystem.

Global rivals are watching closely. A surge in Chinese capacity could lower prices worldwide, intensifying competition. At the same time, U.S. export bans continue to limit Chinese firms’ access to key manufacturing tools, slowing progress.

China’s memory chip drive highlights a pragmatic strategy: dominate areas where progress is possible, even while struggling to match the world’s leaders at the cutting edge.