China’s Chip Supply Chain in 2025: Can Self-Reliance Match Global Standards?

Beijing doubles down on semiconductor independence as U.S. export bans tighten.

China’s ambition to achieve semiconductor self-sufficiency has accelerated sharply in 2025. With the U.S. and its allies tightening restrictions on advanced chip exports, Beijing’s strategy of investing billions into domestic foundries, design firms, and raw material sourcing is being put to the test. The question remains: can China truly match global standards, or will it remain a generation behind?

The U.S. Export Ban and Its Ripple Effects

The Biden administration’s October 2023 sanctions severely restricted China’s access to advanced chip-making equipment, particularly extreme ultraviolet (EUV) lithography machines. In 2024, further measures targeted AI-related chips and cutting-edge GPU exports. These moves have widened the technology gap, forcing China to intensify domestic R&D spending.

Chinese tech giants such as Huawei and SMIC (Semiconductor Manufacturing International Corporation) have responded with in-house innovations, including the release of the 7nm Kirin 9000 chip. However, analysts remain divided: is this breakthrough evidence of resilience, or merely a workaround with limited scalability?

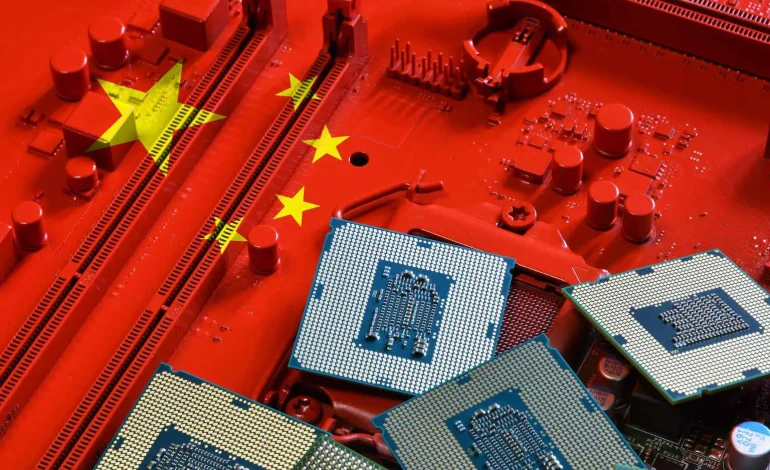

Beijing’s “Self-Reliance” Strategy

China’s government-backed National Integrated Circuit Industry Investment Fund, commonly known as the “Big Fund,” has already funneled over $50 billion into chip projects. Local governments from Shenzhen to Shanghai are providing additional subsidies, creating clusters of fabs, suppliers, and training centers.

Policy directives under the “Made in China 2025” and “14th Five-Year Plan” emphasize:

- R&D in advanced nodes (5nm and below)

- Raw material supply security (rare gases, photoresists)

- Talent development through universities and overseas recruitment

While impressive on paper, execution challenges persist. High costs, technical complexity, and dependency on foreign equipment remain significant obstacles.

Domestic Innovations and Shortfalls

Huawei’s design breakthroughs and SMIC’s incremental progress show signs of momentum. Yet, China still relies heavily on imported semiconductor equipment from ASML, Tokyo Electron, and Applied Materials.

According to industry trackers, China has:

- Advanced to 7nm production with limited yields

- Achieved mass production in 14nm chips (used in mainstream electronics)

- Strengthened its ecosystem of chip design firms (HiSilicon, UNISOC)

However, without access to EUV machines, scaling to 3nm and 2nm nodes, the global cutting edge led by TSMC and Samsung, remains elusive.

The Global Supply Chain Factor

China dominates upstream in rare earth elements, silicon wafers, and assembly services. This gives Beijing leverage in global supply chains. Yet, in the critical middle stage of high-end fabrication, it lags behind Taiwan, South Korea, and the U.S.

Global companies are also rebalancing supply chains. Apple, for example, has shifted parts of its chip supply to India and Vietnam, reflecting geopolitical risk hedging. This leaves China both indispensable and vulnerable.

Outlook for 2025 and Beyond

The near-term outlook suggests China will:

- Narrow the gap in 14nm and 7nm production

- Build resilience in memory chips and mature nodes

- Expand state subsidies to protect domestic champions

But matching TSMC’s 3nm dominance may remain a distant goal. For global tech watchers, the key is not whether China “catches up” tomorrow, but how its incremental progress reshapes industries from smartphones to defense.

Conclusion

China’s chip supply chain in 2025 is a paradox: simultaneously fragile under external pressure yet remarkably resilient due to state backing and domestic innovation. While global standards at the 3nm level remain out of reach, the push for self-reliance ensures that China will continue to be a central, if contested, player in the semiconductor world.